In 2014, HitecVision saw that market conditions would support a new business model: Combining late-life E&P assets with investments in gas infrastructure. Assets of both types were becoming available due to portfolio rationalization by E&P majors. To take advantage of the opportunities, HitecVision decided to create CapeOmega together with a group of entrepreneurs that were looking to start their own business.

Time for growth

CapeOmega was the first operator on the NCS specializing in tail-end production and abandonment, and through this specialization the company aimed to achieve cost savings through scale, the use of state-of-the-art technology and learning from repeated abandonment projects. It was quickly realized that adding infrastructure assets would enhance the business model.

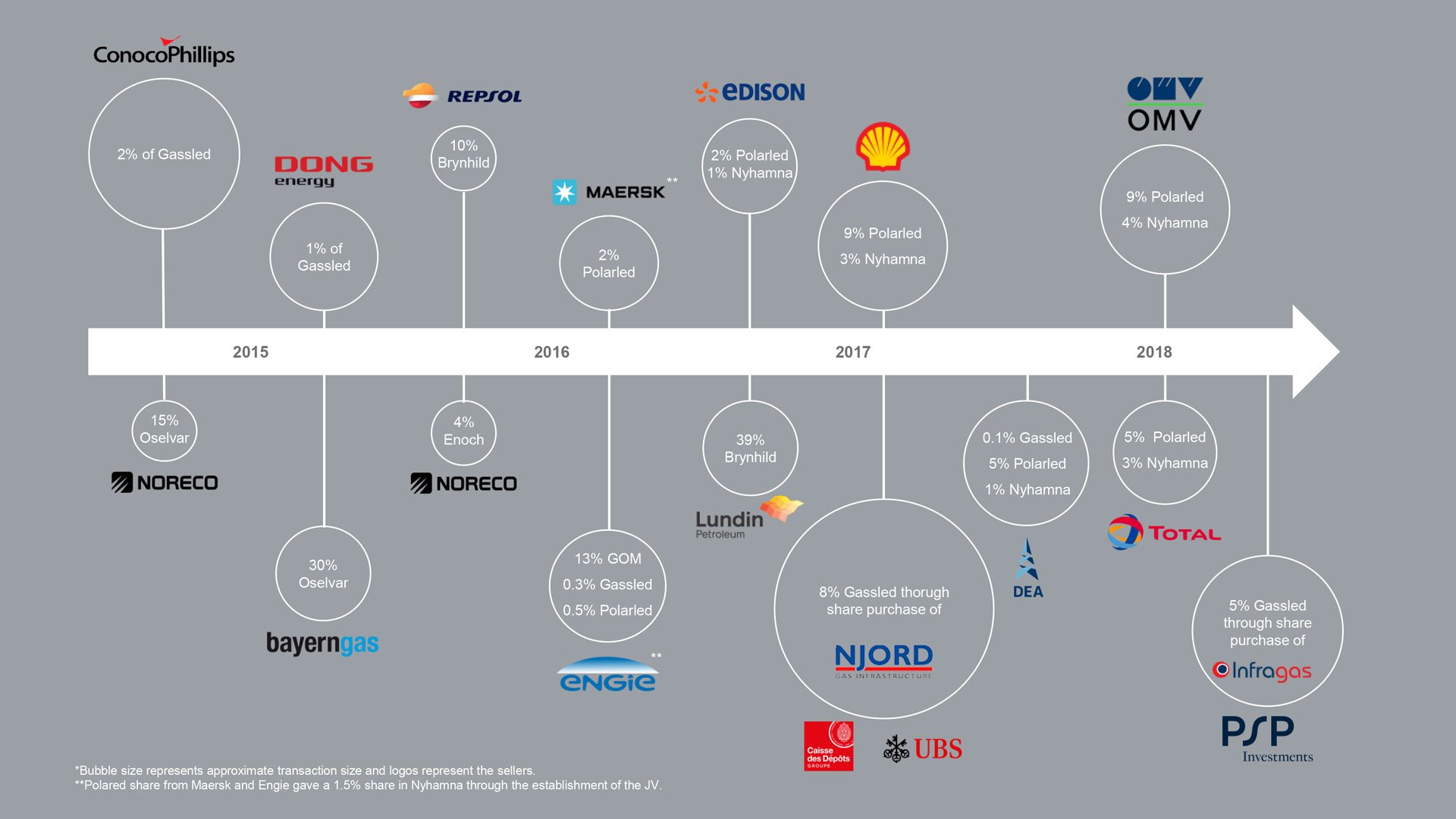

Over the four years from the first acquisition was made in 2015, a total of 16 transactions were concluded: Five late-life E&P asset acquisitions, Nine gas infrastructure asset acquisitions, and two major corporate acquisitions. This coincided with the downturn in the oil and gas industry, where solid and knowledgeable buyers were able to take advantage of the fact that many established companies were looking to realign their asset portfolios.

In parallel with its growing reputation as a reliable counterpart through transacting with major industry players, CapeOmega grew into a significant owner of the European gas transport infrastructure through its holdings in strategic assets, including Gassled, the world’s largest offshore gas transmission system, which covers about 25 percent of Europe’s gas demand.

Working together with the founders, HitecVision built an organization with entrepreneurial and transactional skills combined with the size and competence levels needed to meet the comprehensive formal requirements to become an approved license holder on the Norwegian Continental Shelf (NCS).

Developing a new business model

By developing a business model that combines the low risk and strong cashflow from infrastructure assets with the E&P assets, CapeOmega generated both enhanced leveragability and a solid after-tax cashflow. From using only equity for the first acquisitions, over time the company developed deeper relations with a number of international banks and a significant debt facility tailored to its acquisition program. The company thus became self-financed, providing the basis for further organic and M&A growth.

Time to exit

As the company reached maturity in 2018 it was clear that HitecVision’s value creation targets had been met. Early in 2019 a sale to infrastructure specialists Partners Group was negotiated, valuing CapeOmega at about EUR 1.2 billion. A new phase in the company’s life was ready to begin.